LOC News

Secretary of State Releases Audit on Local CRF Funding

Oregon Secretary of State Bev Clarno has released audit findings on local uses of CRF funds. This document is a “must read” for Coronavirus Relief Fund (CRF) grant managers. It offers helpful reminders about keeping records to justify your expenditures, including noting which guidance is being relied upon, checking submissions for math and classification errors, and a suggestion that higher risk expenditures may be replaced with lower risk expenditures prior to the final deadline.

Perhaps the most interesting conclusion of the audit is that broad claims for public safety payroll (including police, fire, and EMS) are considered a low-risk expenditure. From the audit:

“Three of the local governments we reviewed with the highest payroll costs requested reimbursements for the full costs of public safety and public health personnel. They did not track hours spent on COVID-19 response and provided little documentation of the COVID-19-related work the employees did.

The Treasury and OIG guidance on this varied substantially over time, but as of the date of this letter, appears to have settled on this approach being allowed as an 'administrative convenience' with no documentation required beyond substantiation of position and payroll costs. Unless the guidance changes again, those expenditures appear to be in the low risk category.

For employees not in public health or public safety, some local governments are separately tracking COVID-19-related time on supervisor-approved timesheets to document that employees spent time on COVID-19 tasks, then basing their payroll reimbursement requests on the documented time. This conservative approach seems less likely to be questioned.” (LOC Emphasis)

While there is always a risk that federal guidance will change in the future, this option for utilizing the grant money should come as welcome news to cities with significant funds yet to expend. Cities are also reminded that pushing money up to their counties is an option. As always, work with your city attorney on any planned use of the funds.

Perhaps the most concerning finding of the audit was that less than 50% of the local share of CRF money has been expended. The deadline to utilize these funds is December 30, but cities that do not have a credible plan by early November to expend the funds by the December 30 deadline risk losing these resources.

Communication will be critical in the next two months. If your city does not plan to use your entire allocation, please reach out to LOC at the contact below. If your city has needs beyond its allocation, we need to know that as well. The LOC will be emailing your designated CRF contacts next week to gauge whether it might be possible to pool some unused funds for use by cities who have costs exceeding their allocation. Stay tuned!

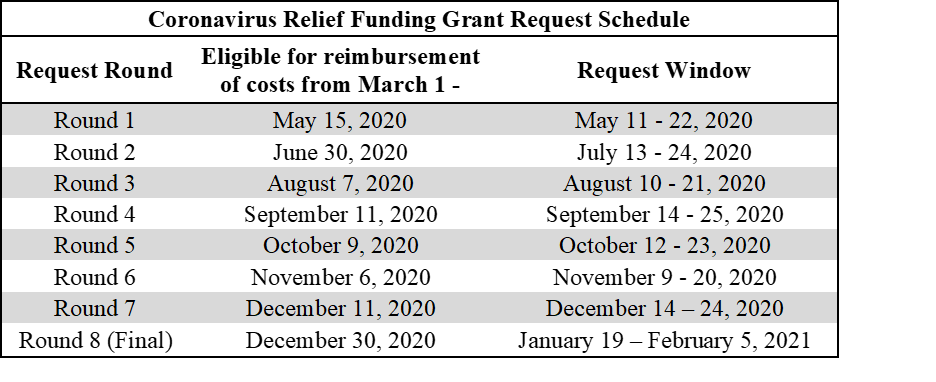

The next reimbursement window runs from November 9 to November 20, for costs expended through November 6. There will be two additional windows covering all costs through December 30.

The links below connect with resources to help with the registration and reimbursement process:

- Access the DAS portal

- Instructions on registering

- Instructions on submitting a reimbursement request

- Spreadsheet with your city share

- U.S. Treasury guidance and FAQ

- Secretary of State Audit

- LOC summary of guidance on economic support programs

- Recording of LOC training

Contact: Mark Gharst, Lobbyist for Tax, Finance, and Economic Development - mgharst@orcities.org or 503-991-2192

Last Updated 10/23/20