ARPA Guidance Webinar

Watch the webinar for an overview of U.S. Treasury guidance and answers to frequently asked questions.

Watch nowSpending Guidance

Previously released guidance on the use of American Rescue Plan funds is available on Treasury’s main ARPA webpage.

The U.S. Treasury has posted a recorded webinar on the new “Final Rule” that will guide how state and local governments may spend their share of federal ARPA funds. The rule significantly increases flexibility in how local governments may use their ARPA funds when compared to the “Interim Final Rule” that cities had been working under previously.

Treasury has a number of related documents on their website. The Final Rule provides the rule text and supplemental information. The Overview of the Final Rule provides a summary of major rule provisions. The Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule provides guidance on the transition period until the Final Rule officially takes effect on April 1, 2022.

The most significant change for most cities will be the ability to claim a minimum allowance for a revenue loss of $10 million and use up to that amount – for most cities this would be their full award – under the very flexible government services spending category with streamlined reporting requirements. The overview document explains “government services generally include any service traditionally provided by a government, unless Treasury has stated otherwise” (page 11), and includes a non-exhaustive list of items, including: road building and maintenance, other infrastructure, general government administration, staff, administrative facilities, and provision of police, fire, and other public safety services.

Other changes in the Final Rule include: new flexibility under the water, sewer, and broadband infrastructure spending category; an enhanced ability to address housing issues; an expanded ability to bolster government employment; and clarification of allowed capital expenditures.

More information is available in this article from the team at the National League of Cities.

Reporting Guidance

Treasury has released additional information on city reporting responsibilities including a guidance document and user guide. These documents provides additional detail and clarification for each recipient’s documentation and reporting responsibilities, and should be read in concert with the above guidance.

· Compliance and Reporting Guidance

· User Guide: Treasury’s Portal for Recipient Reporting

Treasury will be releasing another user guide to assist recipients in gathering and submitting the information for the Project and Expenditure Report through their reporting portal.

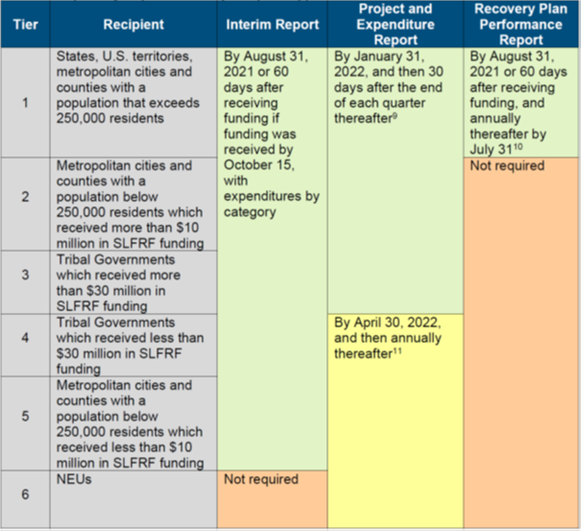

The table below shows the updated due dates and reporting requirements for all cities. The Compliance and Reporting Guidance document has additional details, including the specific due date and coverage period for each required report type.

“Metropolitan cities” are generally cities with a population greater than 50,000 which receive their ARPA funds directly from Treasury, a list of these cities is available here.

“Non-entitlement units of government” (NEUs) are cities that receive their funds from the Oregon Department of Administrative Services, a list of those cities can be found here.

NEUs should have received a notification email from Treasury announcing the opening of a new portal for NEU expenditure reporting. Treasury also released a user guide with step by step instructions on how to set up an account and upload some required documents into the portal. Although NEUs will not have to complete their first Project and Expenditure Report until April 30, cities need to log into this system before then to upload the following documents:

- The signed award terms and conditions agreement submitted to DAS as part of the request for funding;

- The signed assurances of compliance with Title VI of the Civil Rights Act of 1964 submitted to DAS as part of the request for funding; and

- Actual budget documents validating the top-line budget total provided to DAS as part of the request for funding.

Frequently Asked Questions

The following Q&A should help answer some initial questions.

How will the state pass the money through to smaller cities?

- The state will pass through funds according to a predetermined formula, and importantly, the language states that the state “shall” distribute the funds, not that it “may.” The state is still working on details and we will share them as soon as they are available.

Can states place any additional restrictions on ARP funds?

- No, the U.S. Treasury guidance specifies the state may not put any additional restrictions on use aside from what is in the act itself and the associated Treasury guidance.

What can ARP funds be used for?

- The U.S. Treasury guidance above is the definitive source for information on allowed uses of the funds and supports spend in several broad categories as outlined by Treasury.

- Support public health expenditures, by, for example, funding COVID-19 mitigation efforts, medical expenses, behavioral healthcare, and certain public health and safety staff

- Address negative economic impacts caused by the public health emergency, including economic harms to workers, households, small businesses, impacted industries, and the public sector

- Replace lost public sector revenue, using this funding to provide government services to the extent of the reduction in revenue experienced due to the pandemic

- Provide premium pay for essential workers, offering additional support to those who have and will bear the greatest health risks because of their service in critical infrastructure sectors

- Invest in water, sewer, and broadband infrastructure, making necessary investments to improve access to clean drinking water, support vital wastewater and stormwater infrastructure, and to expand access to broadband internet

What uses are not allowed for the funds?

- The Treasury guidance highlights several uses that are not allowed.

- Reducing taxes by legislation, regulation or administration

- Deposits into pension funds

- Payments of outstanding debt or costs associated with issuing new debt

- Payments of settlements or judgments

- Replenishing rainy day funds

Additional information is available on the NLC website.

Contact: Mark Gharst, Lobbyist - mgharst@orcities.org or 503-991-2192