Pandemic Creating Uncertainty in Health Insurance Market

What we’ve been seeing during the pandemic is that some U.S. insurers are paying more for COVID-19 treatment while others are actually paying less in overall medical claims. It’s the same for CIS Benefits. Some of our claims have increased, while others have declined.

What we’ve been seeing during the pandemic is that some U.S. insurers are paying more for COVID-19 treatment while others are actually paying less in overall medical claims. It’s the same for CIS Benefits. Some of our claims have increased, while others have declined.

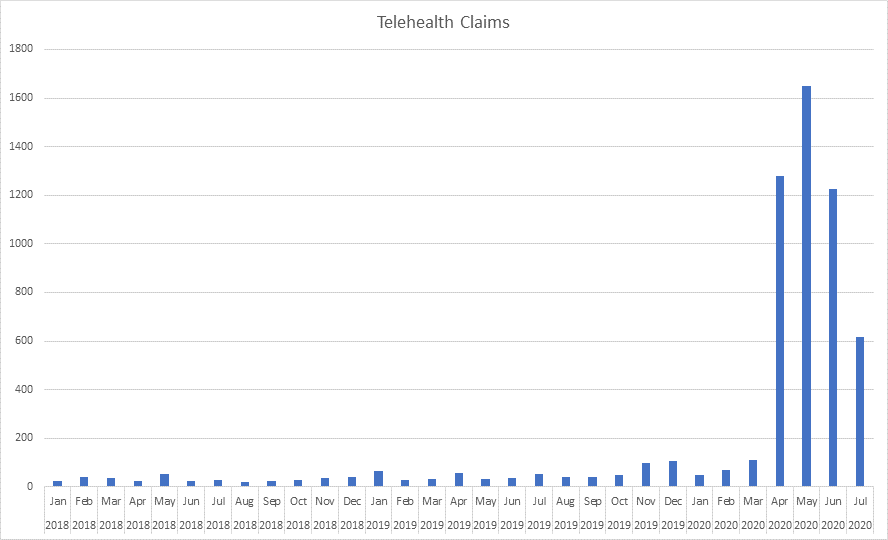

According CIS Benefits Deputy Director Mike Beyrouty, “Our claims data indicates that during the beginning of the pandemic people were postponing non-urgent medical procedures. Since March, we’ve seen more people using Telehealth, but there’s been a sharp drop in elective medical procedures. We expect the increased use of telehealth to continue, even after the pandemic subsides,” he added.

To provide a little more clarity to what we’ve been seeing over these past few months, we’ve run some numbers. For example, telehealth claims averaged about 55 per month prior to March 2020, but in the five months since, they’re averaging nearly 1,000 per month (976), a 1,667% increase during the pandemic.

This year, between March and July, COVID-19 claims accounted for less than 1% of all medical claims. So, you may wonder how much that is in dollars? Based on a total of $34,472,490 paid claims, $254,326 was related to COVID-19.

When looking at medical claims paid based on where the service was received, there was a 15% drop for in-patient hospital stays, a 17% drop in ambulatory surgical centers — an indicator of elective procedures being postponed — and a 3% drop in office visits. Conversely, claims that are on the rise include outpatient hospital care (up 7%), emergency room visits (up 17%), and patient’s home (up 24%).

When looking at medical claims paid based on where the service was received, there was a 15% drop for in-patient hospital stays, a 17% drop in ambulatory surgical centers — an indicator of elective procedures being postponed — and a 3% drop in office visits. Conversely, claims that are on the rise include outpatient hospital care (up 7%), emergency room visits (up 17%), and patient’s home (up 24%).

NOTE: This claims data for CIS Benefits includes only Regence program. Because we’re self-insured with Regence, we collect all the data. Meanwhile, for our Kaiser program, we set the fully-insured rate annually.

Despite Pandemic, CIS Benefits Reserves Remain Strong

Even with the uncertainty caused by COVID-19, there’s one thing that has remained certain — and stable — it’s the strong funding for CIS Benefits.

Late last year, trust reserves were evaluated by an independent actuarial firm and subject to stress testing under hundreds of possible scenarios – including pandemics. They found that CIS Benefits can withstand two 1-in-200-year level events.

Through the leadership of the CIS Board of Trustees, CIS Benefits has a long history of provided health services to public employees.

For 60 years, we’ve partnered with our members and their employees. This has resulted in quality coverage and strong resources at a great price.

“And at CIS Benefits, we look forward to serving Oregon's cities and counties for another 60 years and beyond,” says Beyrouty.

CIS Benefits Team Concerned COVID-19 May Have Lasting Impact on Public Employees

CIS staff do worry that the isolation that COVID-19 has created — as well as the fear of being infected by the coronavirus — may have a lasting impact on some public employees. In fact, mental illness claims are making up an increasing share of all medical claims, up 16% between March and July 2020 compared to the year prior.

CIS’ EAP provider Cascade Centers is a good resource for employees that may need mental health support because of the pandemic. Here are a few things to remember during these difficult times:

Allow yourself to feel sad — it’s okay to grieve. The pandemic is serious. We need to acknowledge the pain and be okay with how we’re feeling. It may be difficult to take a big step, so take some small steps to begin.

Reach out to your network, including work-related contacts, friends and family. Social support is important to all of us at this time. Create rituals to help ease anxiety. Look for mental health support if that feels relieving or helpful. There are many free virtual services available.

During the pandemic, it’s important to care for your mental health and wellbeing. For more information, visit https://cascadecenters.com/COVID19-Oregon-Workplace-Protections-and-Resources.